Estate Planning Life Cycle

by Michael R. Cahill, Esq.

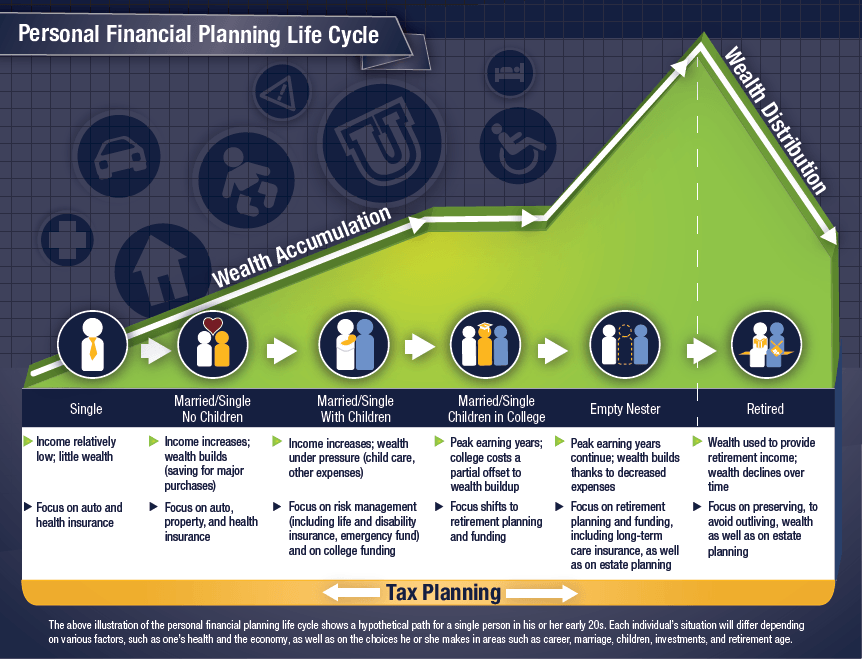

The attached image was prepared for financial advisors and provides a sharp and simplified overview of progressing life stages and their respective planning issues. Granted it's generalized, but it offers a good template for the average person. It doesn't mention focusing on estate planning until the Empty Nester stage, but I would argue estate planning is something that should be a point of emphasis throughout your life, just in varying degrees. Here's my stage by stage Estate Planning Life Cycle model adding a second focus statement to the graphic:Single: "Focus on beneficiary designations and consider a will or trust if assets/plans justify it." Upon death, the law says your probate assets will go to your parents first, then your siblings, nieces/nephews, grandparents, aunts/uncles, cousins, all in succession. They will not go to a boyfriend/girlfriend/fiance, regardless of how long you've been together, unless that person is named as a beneficiary on the asset or in a will. At this stage, at a minimum, I recommend being aware of your beneficiary designations. If you have a house or a fair amount of liquid investments that you want to go to specific people (nieces/nephews' future education, for instance), then a revocable living trust is a priority.

The attached image was prepared for financial advisors and provides a sharp and simplified overview of progressing life stages and their respective planning issues. Granted it's generalized, but it offers a good template for the average person. It doesn't mention focusing on estate planning until the Empty Nester stage, but I would argue estate planning is something that should be a point of emphasis throughout your life, just in varying degrees. Here's my stage by stage Estate Planning Life Cycle model adding a second focus statement to the graphic:Single: "Focus on beneficiary designations and consider a will or trust if assets/plans justify it." Upon death, the law says your probate assets will go to your parents first, then your siblings, nieces/nephews, grandparents, aunts/uncles, cousins, all in succession. They will not go to a boyfriend/girlfriend/fiance, regardless of how long you've been together, unless that person is named as a beneficiary on the asset or in a will. At this stage, at a minimum, I recommend being aware of your beneficiary designations. If you have a house or a fair amount of liquid investments that you want to go to specific people (nieces/nephews' future education, for instance), then a revocable living trust is a priority.

Married, no children: "Focus on probate avoidance strategies like joint ownership or a revocable trust." Here, the law grants most everything to your spouse upon your death. To avoid probate, assets should be owned jointly or have reciprocal beneficiary designations in place. The same rule of thumb above applies here regarding prioritizing a trust if you have a home or have specific plans for your heirs should something happen to you two.

Married/Single with children: "*Focus on naming guardians in a will and consider how kids will inherit."*Regardless of your property, a will is critical to ensure you have guardians named if something happens to you. While not automatic, a guardianship court will give extreme deference to your nominee along with considering the best interests of your child. If you have life insurance that your children stand to inherit, a trust is critical to protect your child not only from outside creditors, but from their own bad decisions as well. Without it, the proceeds will be available when the minor child reaches 18, not always the age when beneficiaries of large sums make the wisest decisions. Your kids are probably not old enough to serve as executors or trustees, so tough decisions will be made about who will fill those roles among your family and friends.

Married/Single, children in college: "*Focus on a comprehensive estate plan using a will and trust to account for all assets."*At this point your estate is rounding into shape. If you have not completed your estate planning by now, you need to. An estate plan will consider your home, retirement and brokerage accounts, vehicles, personal property, and everything else you own. Should something happen to you, you will leave an organized estate plan, free from expensive probate fees and costs, estate tax vulnerability, and the potential chaos of seeking out your assets. Your kids may now be old and responsible enough to fill those important roles that were formerly held by outside family members of friends.

About 75% of my clients are among these four categories above despite most people believing that estate planning isn't something they have to pay any attention to until they're retired. The reality is that a will and trust are simply tools for fulfilling your long-term planning. If you've had children, bought a home, invested in the stock market, or purchased life insurance, you've made deliberate steps to plan for the long term. Without taking the requisite legal steps to formalize your plans, you are putting your heirs and estate in a precarious and expensive position.

About Michael R. Cahill

Mr. Cahill has spent his professional career dedicated to assisting clients with planning their estates, protecting their assets from creditors, and creating business entities to operate companies or manage investments.

Learn more about the attorney →