Information specifically tailored to advisors and clients of American Family Insurance. The following is a primer on wills, trusts, and the part life insurance plays in estate planning.

BASIC ANSWERS TO FUNDAMENTAL QUESTIONS

- What is estate planning? Determining the future disposition of your assets upon your death.

- What is probate? A court’s supervision of the distribution of your assets.

- Why create a will? To formally and legally declare your estate planning intent.

- Why create a trust? To declare your estate planning intent AND do so without court involvement (i.e. probate).

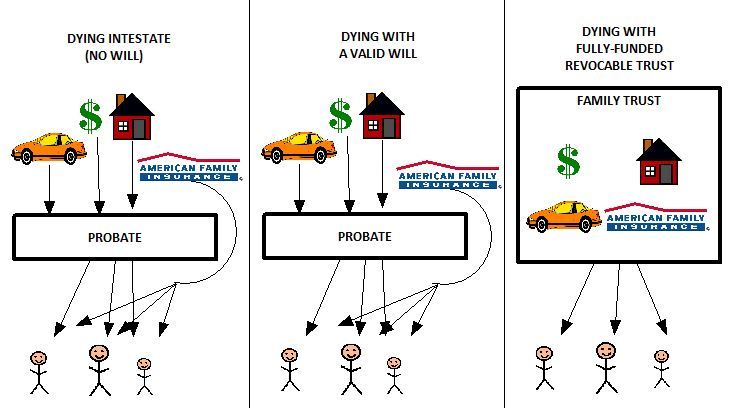

The diagram below is a (very) simplified depiction of estate planning with and without a trust involved:

*Note that the process is much the same whether or not you have a valid last will and testament. A trust avoids the probate process because the assets it holds always have a living owner. Life insurance (as depicted by the AmFam logo) bypasses probate when a living beneficiary is named.

THE THREE ROLES WITHIN A TRUST

- Grantor: A grantor creates the trust and places property into it.

- Trustee: The trustee distributes the trust property to the beneficiaries according to the instructions in the trust. While you’re living, you are the trustee. When you die, the trustee you appointed during your life takes over.

- Beneficiary: The beneficiary is the person/people for whom the trust was created to benefit. While you’re alive, you are the beneficiary. When you die, the person/people you named during your life will be the new beneficiaries.

HOW DOES A TRUST AVOID PROBATE?

Hypothetical #1: Dad has a bank account. Dad dies. Sons goes to bank to close account and take funds. Bank won’t cooperate.

Any asset that 1) is maintained by an institution (i.e. bank, county recorder, DMV), and 2) no longer has a living owner upon the death of the original owner must go through the probate process. Probate determines the legal heir to such an asset. So in the hypothetical above, the bank cannot grant the funds to Son because it does not have the authority to confirm the legal heir. Son will need to go through probate and obtain a court order requiring bank to give him those funds.

Unlike people, a trust does not die. So it overcomes requirement two above by serving as a living owner of an asset. The trust designates the new beneficiary of the asset. So …

Hypothetical #2: Dad has placed bank account in a revocable living trust. Dad dies. Son goes to bank to close account and take funds. Son shows bank that he is successor trustee of the trust. Bank has him sign account documents and son takes over control of the account.

HOW A REVOCABLE TRUST ENHANCES LIFE INSURANCE

1. Establish Age Thresholds: You may designate any age after 18 for your beneficiary to receive the policy death benefit. Delay distribution until the beneficiary is of a more mature age, or portion it out over time (i.e. 1/3 at 25, 1/3 at 30, 1/3 at 35).

2. Require Specific Use: Mandate that funds only be used for higher education or to pay off a mortgage.

3. Grant Discretionary Distributions: Give the trustee the freedom to make early distributions for specific purposes you determine, or for reasons the trustee determines are in line with what your desires would have been.

4. Establish Conditions and Performance Thresholds: Require a four-year college degree or sobriety for five years before access to a lump sum.

5. Protection from Creditors: Ensure that the inheritance left behind will remain in the bloodline. Asset protection provisions built into the trust can safeguard the funds from future creditors and ex-spouses.

COMMON MISCONCEPTIONS ABOUT TRUSTS

1. If I create a trust and I want to make changes down the road, I have to start all over again.

False. You retain the power to revoke or amend a revocable trust at any time.

2. Now that I’ve signed my trust, my assets won’t have to go through probate.

False. Your trust is an empty bucket. It needs to be filled by retitling your assets in its name (known as “funding the trust”).

3. Once I put assets in a trust, I lose control of them.

False. Since you retain power to revoke the trust, you maintain power over the trust assets.

4. If I close a bank account owned by the trust or buy a new house, I have to amend my trust.

False. The trust document doesn’t dictate what the trust owns, per se. Retitling your assets does.

5. I’ve moved to a different state. My trust established in my old state is now invalid.

False. State to state treatment of a trust is generally the same. However, it may be a good time to revisit the trust terms and confirm they still describe what you want.

6. If I get sued, my revocable trust will protect my trust assets.

False. While legal title is not in your name, your retained power to revoke the trust means any creditor can reach the trust assets through a valid judgment.

OTHER REASONS TO ENGAGE IN ESTATE PLANNING

- Appoint guardians for minor children: If you have minor children, you need to create a will nominating whom you choose to be the guardian of your children upon your death. If you have not done this, a court may have to follow a lengthy and expensive process to determine an appropriate guardian for your minor children.

- Maintain harmony in the family. Avoiding hard feelings, fights or litigation within your own family may be the most important benefit of a good estate plan. A well-designed estate plan, along with thoughtful selection of an appropriate executor and trustee, is critical for accomplishing this goal.

- Plan for Incapacity. Estate planning isn’t limited post-death asset management. If you are incapacitated, your successor trustee can manage your assets for you, paying your bills and maintaining your property until you regain capacity to do so for yourself.

- Protect assets from your children and for your children. Your trust can make sure your children do not get too much too soon or for the wrong purposes. Special provisions in your trust can also protect the inheritance you leave for your children from lawsuits, bankruptcy, or divorce.

- Save money. Through your will and trust you can waive the requirement that your executor or trustee obtain a bond. Your chosen trustee may waive administration fees, and avoiding probate means no filings fees and more importantly, no attorney’s fees.

- Sign a health care directive and power of attorney. Give authority to your appointed agent to act on your behalf for medical decisions and to access your medical records and instruct them on your desires should you enter into a persistent vegetative state (i.e. the Terry Schiavo case).